UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RuleRULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

|

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material |

AV HOMES, INC.

(Name of Registrant as Specified In Itsin its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: |

AV HOMES, INC.

8601 N. Scottsdale Road

Suite 2225

Scottsdale, Arizona 85253

(480) 214-7400

To our Stockholders:

AV Homes, Inc. (the “Company,” “we,” “us” or “our”) will hold a special meeting of our stockholders (the “Special Meeting”) on September 18, 2013 at 8:00 a.m. Mountain Standard Time, at our offices at 8601 N. Scottsdale Road, Suite 2225, Scottsdale, Arizona 85253.

On June 19, 2013, we entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with TPG Aviator, L.P. (“TPG Aviator” or the “Investor”), an affiliate of TPG Global, LLC. Pursuant to the Securities Purchase Agreement, we agreed to sell to the Investor for an aggregate purchase price of $135 million (i) 2,557,474 shares of our common stock, par value $1.00 per share, and (ii) 665,754.3 shares of our newly authorized Series A Contingent Convertible Cumulative Redeemable Preferred Stock, par value $0.10 per share (the “Series A Preferred Stock”). We refer to this investment by the Investor as the “Investment.” The closing of the Investment occurred on June 20, 2013.

At the Special Meeting, holders of shares of our common stock (other than TPG Aviator) will be asked to consider and vote on a proposal to approve the following rights in connection with the Investment: (i) the right to convert, at the option of the Company or the holders of our Series A Preferred Stock, shares of our Series A Preferred Stock into shares of our common stock (the “Conversion Right”) and (ii) the Investor’s pre-emptive rights following approval of such conversion to participate in future Company issuances of its common stock or securities convertible into or exercisable for its common stock (the “Pre-Emptive Right”), each of which right requires the approval of the Company’s stockholders in accordance with the rules and regulations of The Nasdaq Stock Market, Inc. (“Nasdaq”), together with the related rights of the Investor (collectively, the “Equity Rights Proposal”).

Our Board of Directors unanimously approved the proposal and recommends that our stockholders vote “FOR” the proposal.

If our stockholders do not approve the proposal presented at the Special Meeting, the Series A Preferred Stock will not be convertible into our common stock, and, unless and until stockholder approval is subsequently obtained and the Company or the holder(s) of the Series A Preferred Stock elects to convert the Series A Preferred Stock into shares of our common stock, the dividend rate applicable to the Series A Preferred Stock will increase to (i) 8% per annum beginning 180 days after closing of the Investment (which date is December 17, 2013) and continuing for nine months (which ending date is September 17, 2014), (ii) 12% per annum beginning September 18, 2014 and continuing for twelve months (which ending date is September 17, 2015), and (iii) 15% per annum thereafter. During the first nine-month period, the Company may, at its election, pay the dividends in cash or in kind by issuing additional shares of Series A Preferred Stock (as long as the as-converted ownership of TPG Aviator and its affiliates would not exceed 49% of the common stock issued and outstanding). The Company must pay subsequent dividends in cash. These dividends will be net of the amount of any common stock participating dividends received by the holders of Series A Preferred Stock during such periods. In addition, if any Series A Preferred Stock remains outstanding 180 days after closing of the Investment, (a) the liquidation preference for the Series A Preferred Stock

will increase by 10% and (b) the conversion ratio for conversion of the Series A Preferred Stock into the Company’s common stock will increase by 10%. The increase in liquidation preference will cause the effective dividend rates on the Series A Preferred Stock to be 10% higher. Further, if our stockholders do not approve the Equity Rights Proposal at the Special Meeting, TPG Aviator has the right, among other things, to require us to use our reasonable best efforts to call subsequent special meetings of our stockholders to approve the Equity Rights Proposal as described in the accompanying proxy statement.

Please carefully read the accompanying proxy statement in its entirety for information about the matters to be voted upon. You may also obtain more information about the Company from documents we have filed with the Securities and Exchange Commission; see “Where You Can Find More Information” in the accompanying proxy statement. Your vote is important. Whether or not you plan to attend the meeting in person, we urge you to submit your proxy as soon as possible via the Internet, by telephone or by mail.

Sincerely,

/s/ Roger A. Cregg

Roger A. Cregg

President and Chief Executive Officer

Dated: August 7, 2013

AV HOMES, INC.

8601 N. Scottsdale Road

Suite 2225

Scottsdale, Arizona 85253

(480) 214-7400

NOTICE OF SPECIAL MEETING OF

STOCKHOLDERS TO BE HELD ON SEPTEMBER 18, 2013

SCHEDULED MEETING DATE: | September 18, 2013 | |

MEETING TIME: | 8:00 a.m. Mountain Standard Time | |

RECORD DATE: | August 2, 2013 | |

LOCATION: | The Company’s offices at 8601 N. Scottsdale Road, Suite 2225, Scottsdale, Arizona 85253 | |

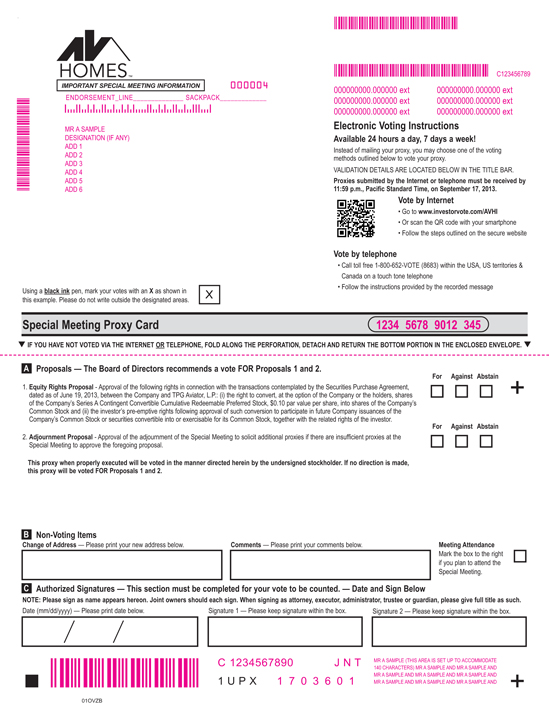

ITEMS OF BUSINESS: | 1. To consider and vote on a proposal to approve the following rights in connection with the transactions contemplated by the Securities Purchase Agreement, dated as of June 19, 2013 (the “Securities Purchase Agreement”), between AV Homes, Inc. (the “Company,” “AV Homes,” “we,” “us” or “our”) and TPG Aviator, L.P. (“TPG Aviator” or the “Investor”): (i) the right to convert, at the option of the Company or the holders, shares of our Series A Contingent Convertible Cumulative Redeemable Preferred Stock, $0.10 par value per share, into shares of our common stock (the “Conversion Right”) and (ii) the Investor’s pre-emptive rights following approval of such conversion to participate in future Company issuances of its common stock or securities convertible into or exercisable for its common stock (the “Pre-Emptive Right”), together with the related rights of the Investor (collectively, the “Equity Rights Proposal”). 2. To consider and vote on a proposal to approve the adjournment of the Special Meeting to solicit additional proxies if there are insufficient proxies at the Special Meeting to approve the foregoing proposal. | |

These items of business are described in the proxy statement accompanying this Notice. We are required to seek approval for the Equity Rights Proposal set forth above pursuant to the terms of the Securities Purchase Agreement and other agreements and documents entered into in connection with the transactions contemplated thereby and in order to comply with the rules and regulations of The Nasdaq Stock Market, Inc. (“Nasdaq”).

The AV Homes, Inc. Board of Directors unanimously recommends that stockholders vote “FOR” each of the proposals.

The record date for the Special Meeting is August 2, 2013. Holders of record of our common stock at the close of business on the record date will be entitled to vote at the Special Meeting and any adjournments or postponements of the Special Meeting; however, TPG Aviator is not entitled to vote on the Equity Rights Proposal presented at the Special Meeting.

You can vote in one of four ways:

| (1) | Visit the website noted on your proxy card to votevia the Internet; |

| (2) | Use the telephone number on your proxy card to voteby telephone; |

| (3) |

|

| (4) |

|

AV HOMES, INC.

8601 N. SCOTTSDALE RD., SUITE 225

SCOTTSDALE, ARIZONA 85253

(480) 214-7400

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 5, 2013

To the Stockholders of AV Homes, Inc.:

The Annual Meeting of Stockholders of AV Homes, Inc. (“AV Homes” or the “Company”) will be held at the FireSky Resort located at 4925 North Scottsdale Road, Scottsdale, Arizona 85251 on June 5, 2013, at 8:00 a.m. local time, for the following purposes:

|

|

|

The Board of Directors has fixed the close of business on April 12, 2013 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or adjournments thereof.

Please mark your proxy if you wish to attend the Annual Meeting in order that adequate preparations may be made. A meeting attendance card will be mailed promptly to you to facilitate your attendance.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE ANNUALSPECIAL MEETING, PLEASE COMPLETE, DATE, SIGN, AND RETURN THE ENCLOSED PROXY CARD PROMPTLY IN THE POSTAGE-PREPAID ENVELOPE PROVIDED FOR YOUR CONVENIENCE. YOU MAY ALSO VOTE VIA INTERNET OR BY TELEPHONE IN ACCORDANCE WITH THE INSTRUCTIONS ON YOUR PROXY CARD.

By Order of the Board of Directors,

/s/ Dave M. Gomez

Dave M. Gomez

Executive Vice President,

General Counsel and Secretary

Dated: April 24, 2103August 7, 2013

YOU CAN VOTE IN ONE OF FOUR WAYS:

|

|

|

|

PROXY STATEMENT

FOR THE

SPECIAL MEETING OF STOCKHOLDERS

OF AV HOMES, INC.

TO BE HELD ON SEPTEMBER 18, 2013

Address of Special Meeting:

8601 N. SCOTTSDALE RD., SUITE 225

SCOTTSDALE, ARIZONAScottsdale Road, Suite 2225, Scottsdale, Arizona 85253

(480) 214-7400

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 5, 2013

This Proxy Statement and the enclosed formSolicitation of proxy are furnished to the stockholders of AV Homes, Inc., a Delaware corporation (“AV Homes” or the “Company”), in connection with the solicitation of proxiesProxies by and on behalf of the Board of Directors

Our Board of AV Homes for useDirectors (the “Board”) is soliciting proxies to be voted at the Annual Meetingspecial meeting of Stockholdersthe Company’s stockholders scheduled to be held at the FireSky Resort located at 4925 North Scottsdale Road, Scottsdale, Arizona 85251 on June 5,September 18, 2013, at 8:00 a.m. local timeMountain Standard Time, at our offices at 8601 N. Scottsdale Road, Suite 2225, Scottsdale, Arizona 85253 (the “Annual“Special Meeting”), and any adjournments or postponements of the Special Meeting, for the purposes set forth in the attached Notice of Special Meeting of Stockholders To Be Held On September 18, 2013 (the “Notice”).

This Proxy Statement and the form of proxy enclosed herewith and the accompanying Annual Report of AV Homes for the fiscal year ended December 31, 2012, including financial statements, are first being mailed on or about April 24,August 12, 2013, to stockholders of record on the close of business on April 12,August 2, 2013. Our stockholders are invited to attend the Special Meeting and are requested to vote on each of the proposals described in this Proxy Statement. In this Proxy Statement, we refer to AV Homes, Inc. as the “Company,” “AV Homes,” “we,” “our” or “us.”

PURPOSES OF THE MEETINGQuestions and Answers about these Proxy Materials and the Special Meeting

Why am I receiving these materials? What is the purpose of the Special Meeting?

On June 19, 2013, the Company and TPG Aviator, L.P. (“TPG Aviator” or the “Investor”), an affiliate of TPG Global, LLC (together with its affiliates, “TPG”), entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”), pursuant to which TPG Aviator agreed to purchase 2,557,474 shares of the Company’s common stock at a purchase price of $14.65 per share, and 665,754.3 shares of a newly authorized series of the Company’s Series A Contingent Convertible Cumulative Redeemable Preferred Stock, $0.10 par value per share (the “Series A Preferred Stock”), at a purchase price of $146.50 per share. The investment contemplated by the Securities Purchase Agreement (the “Investment”) closed on June 20, 2013. As described in more detail below, in accordance with the terms of the Investment Documents (as defined below) and applicable rules, regulations and guidance of The Nasdaq Stock Market, Inc. (“Nasdaq”), the Company is calling a special meeting of its stockholders to consider and vote on a proposal to approve certain of the Investor’s rights associated with the Series A Preferred Stock. The Special Meeting described in this Proxy Statement is scheduled to be held on September 18, 2013, and we are providing these proxy materials to you in connection with the Special Meeting.

At the AnnualSpecial Meeting, stockholdersholders of shares of our common stock will be asked to consider and vote uponon the following matters:proposals:

| 1. | To |

| 2. | To approve the |

|

VOTING RIGHTS AND PROXY INFORMATION

Record Date; Voting

How does the Board recommend that I vote on the Equity Rights Proposal and the Adjournment Proposal?

The Board unanimously approved the Equity Rights Proposal and the Adjournment Proposal, and unanimously recommends that the Company’s stockholders vote “FOR” each of these proposals.

Why did the Company approve the Investment?

The Board approved the Investment to raise capital that we intend to use to accelerate implementation of our strategic plan, including pursuing new investment opportunities in our core markets. For a more detailed description of the background of the Investment, see “Proposal One: Equity Rights Proposal—Background of the Investment” below.

Why is the Company seeking approval of the Equity Rights Proposal?

We are required to seek approval of the Equity Rights Proposal pursuant to the terms of the Securities Purchase Agreement and the related agreements and other documents entered into by the Company and TPG Aviator and other affiliates of TPG in connection with the Securities Purchase Agreement, including the Stockholders Agreement, dated as of June 20, 2013 (the “Stockholders Agreement”), by and among the Company and the Investor, and the Management Services Agreement, dated as of June 20, 2013 (the “Management Services Agreement”), by and among the Company and TPG VI Management, LLC, an affiliate of TPG Aviator (“TPG Management”). The Securities Purchase Agreement and such related agreements and other documents are referred to herein, collectively, as the “Investment Documents.”

In addition, the Company’s common stock is listed on Nasdaq and, as a result, the Company is subject to certain Nasdaq listing rules and regulations. Nasdaq Rule 5635(b) requires stockholder approval prior to any issuance of securities when the issuance will result in a change of control of the Company, which Nasdaq deems to occur when, as a result of the issuance, an investor owns, or has the right to acquire, 20% or more of the outstanding shares of our common stock or voting power and such ownership would be the single largest ownership position in the company. Because of this restriction, in exchange for the Investor’s $135 million investment in the Company, the Investor received 2,557,474 shares of our common stock at the closing of the Investment, representing approximately 19.9% of our common stock outstanding prior to the issuance, and, instead of additional shares of our common stock, the Investor received 665,754.3 shares of our newly authorized Series A Preferred Stock. Pursuant to the By-Lawsterms of AV Homes, the Company’s Certificate of Designation relating to the Series A Preferred Stock (the “Certificate of Designation”), the Series A Preferred Stock will only become convertible into our common stock following stockholder approval.

Nasdaq has certain additional rules, including Nasdaq Rule 5635(c) that requires stockholder approval prior to certain issuances of securities to directors, that could be implicated in the future if the Investor exercises the Pre-emptive Right. In order to eliminate any requirement that the future exercise of the Pre-emptive Right would require stockholder approval, we are seeking such approval now as part of the Equity Rights Proposal. For a more detailed description of the Pre-Emptive Right, see the description under “Description of the Investment Documents—Stockholders Agreement—Pre-emptive Rights” below.

What will happen if the Company’s stockholders do not approve the Equity Rights Proposal?

If the Company’s stockholders do not approve the Equity Rights Proposal, then the right to convert each share of the Series A Preferred Stock into ten shares of common stock would not become effective.

Furthermore, unless and until stockholder approval is subsequently obtained and the Company or the holder(s) of the Series A Preferred Stock elect to convert the Series A Preferred Stock into shares of our common stock, the dividend rate applicable to the Series A Preferred Stock will increase to (i) 8% per annum beginning 180 days after closing of the Investment (which date is December 17, 2013) and continuing for nine months (which ending date is September 17, 2014), (ii) 12% per annum beginning September 18, 2014 and continuing

for twelve months (which ending date is September 17, 2015), and (iii) 15% per annum thereafter. During the first nine-month period, the Company may, at its election , pay the dividends in cash or in kind by issuing additional shares of Series A Preferred Stock (as long as the as-converted ownership of TPG Aviator and its affiliates would not exceed 49% of the common stock issued and outstanding). The Company must pay subsequent dividends in cash. These dividends will be net of the amount of any common stock participating dividends received by the holders of Series A Preferred Stock during such periods. In addition, if any Series A Preferred Stock remains outstanding 180 days after closing of the Investment, (a) the liquidation preference for the Series A Preferred Stock will increase by 10%, as described in “Description of the Series A Preferred Stock—Liquidation Rights” below, and (b) the conversion ratio for conversion of the Series A Preferred Stock into the Company’s common stock will increase by 10%, as described in “Description of the Series A Preferred Stock—Conversion” below. The increase in liquidation preference will cause the effective dividend rates on the Series A Preferred Stock to be 10% higher.

Additionally, as described under “Description of the Investment Documents—Stockholders Agreement—Pre-emptive Rights” below, unless and until the Company’s stockholders have approved the Equity Rights Proposal, TPG Aviator will have the pre-emptive right (at its option) to purchase, or to designate an affiliate to purchase, TPG Aviator’s pro rata portion of any equity issuances by the Company by purchasing additional shares of Series A Preferred Stock in lieu of, and with the same value as, the securities TPG Aviator otherwise would have been entitled to purchase under its pre-emptive rights described below. Finally, if the stockholders do not approve the Equity Rights Proposal at the Special Meeting, then, upon TPG Aviator’s request, the Company is obligated to use its reasonable best efforts to call additional stockholders’ meetings on two additional occasions during the first year following the closing of the Investment and on an annual basis thereafter for the purpose of obtaining such approval.

What will happen if the Company’s stockholders approve the Equity Rights Proposal?

If the Company’s stockholders approve the Equity Rights Proposal, the Company intends to promptly exercise its right to convert each outstanding share of the Series A Preferred Stock into ten shares of common stock. Based on the capitalization of the Company as of the record date, August 2, 2013, the conversion of all of the outstanding shares of the Series A Preferred Stock into shares of common stock would result in TPG Aviator owning approximately 41.9% of our outstanding common stock, including the 2,557,474 shares of common stock purchased by TPG Aviator at the closing of the Investment.

In addition, as described under “Description of the Investment Documents—Stockholders Agreement—Pre-emptive Rights” below, once the Company’s stockholders have approved the Equity Rights Proposal, TPG Aviator will no longer have the right to purchase additional shares of Series A Preferred Stock in lieu of the securities TPG Aviator otherwise would be entitled to purchase under its pre-emptive rights described below.

Upon stockholder approval of the Equity Rights Proposal (whether or not the shares of Series A Preferred Stock are converted to shares of common stock), we will increase the size of our board to ten members, which will include two additional directors nominated by TPG Aviator (for a total of four) as described under “Description of the Investment Documents—Stockholders Agreement—Board Representation and Observer Rights.” At the same time, TPG Aviator’s right to appoint two observers to our Board, as described under “Descriptions of Directors has fixedthe Investment Documents—Stockholders Agreement—Board Representation”, would be terminated. The number of directors that TPG Aviator is entitled to nominate would decrease as the percentage ownership of TPG Aviator and its affiliates falls below certain thresholds, as described under “Description of the Investment Documents—Stockholders Agreement—Board Representation and Observer Rights.”

Will the Conversion Right be dilutive to existing holders of the Company’s common stock?

The Conversion Right, when exercised, will be dilutive to existing stockholders. Approval of the Equity Rights Proposal will allow the holders of the Series A Preferred Stock to convert their shares of Series A Preferred Stock into shares of the Company’s common stock. Based on the capitalization of the Company as of

the record date, August 2, 2013, the conversion of all of the outstanding shares of the Series A Preferred Stock into shares of common stock would result in TPG Aviator owning approximately 41.9% of our outstanding common stock, including the 2,557,474 shares of common stock purchased by TPG Aviator at the closing of the Investment. At the same time, however, exercise of the Conversion Right would eliminate the outstanding Series A Preferred Stock, which is senior to the common stock as to payment of dividends and to distribution of assets upon liquidation, dissolution or winding up of the Company.

Who is entitled to vote at the Special Meeting?

The record holders of the 15,343,266 shares of the Company’s common stock outstanding at the close of business on April 12,August 2, 2013 as the record date for the determination of stockholdersare entitled to notice of and to vote at the meeting or any adjournment or adjournments thereof.

AtSpecial Meeting, except as set forth below. The holders of the close of business on April 12, 2013, 12,824,153 shares of Common Stock, $1.00 par value, of AV Homes (“Common Stock”), which constitutes the only class of voting securities of AV Homes, were outstanding and entitled to vote. For each share of Common Stock held of record on the close of business on April 12, 2013, stockholdersCompany’s common stock are entitled to one vote except in regardfor each share of common stock on each matter submitted to a vote at the election of directors, for which there will be cumulative votingSpecial Meeting. However, TPG Aviator, as described under the heading “Election of Directors.” In accordance with AV Homes’ By-Laws, the holders of a majorityholder of the outstanding shares of Common Stock, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

Proxies

When a proxyCompany’s common stock, is received, properly executed, in time for the Annual Meeting, the shares represented thereby will be voted at the meeting as directed. Shares represented by valid proxies which do not contain voting instructions will be voted: (1) FOR the election as directors of AV Homes the six nominees named herein, (2) FOR approval of the appointment of Ernst & Young LLP as independent registered public accounting firm for AV Homes for the year ending December 31, 2013, and (3) in connection with the transaction of such other business as properly may come before the meeting in accordance with the judgment of the person or persons voting the proxy. Any stockholder who

executes a proxy may revoke it at any time prior to its exercise by giving written notice of such revocation to the Secretary of AV Homes. In addition, a stockholder who attends the meeting may vote in person, thereby cancelling any proxy previously given by such stockholder.

If you are the beneficial owner of shares held for you by a bank, broker or other holder of record and do not return your voting instructions, the broker or other nominee may vote your shares solely with respect to such matters for which the broker or other nominee has discretionary authority. Under applicable rules, brokers have discretionary authorityentitled to vote on routine matters, which includes the approvalEquity Rights Proposal presented at the Special Meeting, but is permitted to vote on the Adjournment Proposal. TPG Aviator, as a holder of the appointment of the independent registered public accounting firm. Brokers will not have the discretionSeries A Preferred Stock, has no right to vote on any of the other matters described in this Proxy Statement.

What is the required quorum to come beforehold the Annual Meeting.Special Meeting?

Nominees for director will be electedIn order to conduct the Special Meeting, the presence, in person or by a pluralityproperly executed proxy, of the votes cast (i.e., the highest number of votes cast) at the Annual Meeting by the holders of Common Stockshares of common stock entitled to exercise a majority (i.e., greater than 50%) of the voting power of the Company is necessary to constitute a quorum. Shares of common stock represented by a properly signed, dated and returned proxy card, or proxies submitted by telephone or online, including abstentions and broker non-votes, will be treated as present at the Special Meeting for purposes of determining a quorum.

What vote is required to approve each of the proposals?

Approval of the Equity Rights Proposal requires the affirmative vote of a majority of votes which all stockholders present in person or by proxy andat the Special Meeting are entitled to noticecast on the proposal, assuming a quorum is present. TPG Aviator, as holder of andthe Company’s common stock, is not entitled to vote on the Equity Rights Proposal presented at the AnnualSpecial Meeting. Consequently, only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality. Withheld votes and broker non-votes will have no effect on the election of directors.

The affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to notice of, and to vote at, the Annual Meeting is necessary to ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for AV Homes for the year ending December 31, 2013. Abstentions will have the same effect as votes against such proposal because the shares are considered present at the meeting but are not affirmative votes.votes, however, broker non-votes will not be counted towards the tabulation of votes cast and will not affect the outcome of the Equity Rights Proposal.

Approval of the Adjournment Proposal requires the affirmative vote of a majority of the shares of common stock represented in person or by proxy at the Special Meeting, whether or not a quorum is present. Accordingly, an abstention or a broker non-vote would have the effect of a vote against the proposal.

Can I find additional information on the Company’s website?

Yes. Our website is www.avhomesinc.com. Although the information contained on our website is not part of this Proxy Statement, you can view additional information on the website, such as our code of conduct, corporate governance guidelines, charters of Board committees and SEC filings. A copy of our code of conduct, corporate governance guidelines and each of the charters of our Board committees may be obtained free of charge by writing to Corporate Secretary, AV Homes, Inc., 8601 N. Scottsdale Rd., Suite 225, Scottsdale, AZ 85253 or by calling us at (480) 214-7000.

How do I vote?

Voting in Person at the Special Meeting. If you are a stockholder of record, you may vote in person at the Special Meeting. If your shares of common stock are held in street name and you wish to vote in person at the Special Meeting, you will need to obtain a “legal proxy” from the broker, bank or other nominee that holds your shares of common stock of record.

Voting by Proxy for Shares Registered Directly in the Name of the Stockholder. If you hold your shares of common stock in your own name as a holder of record with our transfer agent, Computershare Investor Services, you may instruct the proxy holders named in the proxy card how to vote your shares of common stock in one of the following ways:

| • | Vote online. Visit the website noted on your proxy card to vote via the Internet. |

| • | Vote by telephone. Use the telephone number on your proxy card to vote by telephone. |

| • | Vote by regular mail. Sign, date and return your proxy card in the enclosed envelope to vote by mail. |

Voting by Proxy for Shares Registered in Street Name. If your shares of common stock are held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted.

Regardless of how you choose to vote, your vote is important to us and we encourage you to vote promptly.

What happens if I return my proxy card without voting on all proposals?

When you return a properly executed proxy card, the Company will vote the shares that the proxy card represents in accordance with your directions. If you return the signed proxy card with no direction on a proposal, the Company will vote your proxy “FOR” the Equity Rights Proposal and “FOR” the Adjournment Proposal.

Can I change my vote after I have voted?

You can revoke your proxy and change your vote at any time before the polls close at the Special Meeting. You can do this by:

filing a written revocation with the Secretary of the Company;

signing and submitting another proxy with a later date; or

attending the Special Meeting, withdrawing the proxy and voting in person.

Who is soliciting the proxy and who pays the costs?

The enclosed proxy for the Special Meeting is being solicited by the Board. The cost of soliciting the proxies on the enclosed form will be paid by the Company. In addition to the use of the mail, proxies may be solicited by the directors and their agents (who will receive no additional compensation for those services) by means of personal interview, telephone, facsimile, e-mail or other electronic means, and it is anticipated that banks, brokerage houses and other institutions, nominees or fiduciaries will be requested to forward the soliciting material to their principals and to obtain authorization for the execution of proxies. The Company may, upon request, reimburse banks, brokerage houses and other institutions, nominees and fiduciaries for their expenses in forwarding proxy material to their principals.

What happens if the Special Meeting is postponed or adjourned?

If the Special Meeting is postponed or adjourned due to a lack of a quorum or to solicit additional proxies, we intend to reconvene the Special Meeting as soon as reasonably practical. Your proxy will still be effective and may be voted at the rescheduled or adjourned meeting, and you will still be able to change or revoke your proxy until it is voted at the rescheduled or adjourned meeting.

Who should I call if I have questions or need assistance voting my shares?

Please call Dave M. Gomez, Executive Vice President, General Counsel and Corporate Secretary, at (480) 214-7000 if you have any questions or require assistance in connection with voting your shares.

Proposal One: Equity Rights Proposal

Approval of the Conversion Right and the Pre-Emptive Right

Background of the Investment

Since 2011, we have strategically re-engineered the Company to position it to benefit from the recovery of the homebuilding industry. We reduced overhead, launched initiatives to improve internal processes, invested in a new scalable IT platform and developed a strategic plan to attendguide our growth. Our strategic plan involves investing in existing and new high-potential housing markets through the development of active adult communities designed for people age 55 or older through our Vitalia brand and serving the housing needs of first-time and move-up homebuyers through our Joseph Carl Homes brand. In order to accelerate implementation of our strategy, beginning in the first half of 2013, we began exploring options to raise additional capital, including a potential public offering of securities. In late April 2013, we began discussions for a potential equity investment by TPG, a global private investment firm. We were attracted to the opportunity with TPG because (i) it provided a large single source of capital in one transaction to accelerate execution of our strategy, (ii) the issue price negotiated was at a 9.6% premium to our 30-day trailing average common stock price, and (iii) we believe that the strategic relationship with TPG will provide significant benefits to us as a result of TPG’s broad relationships in our industry. Additionally, we believe that TPG brings macroeconomic and real estate insights that will help us to execute our investment strategy more effectively.

During May and June 2013, the Company and TPG negotiated the terms of the potential equity investment and we entered into definitive documentation on June 19, 2013. Pursuant to the Securities Purchase Agreement, which we signed on June 19, 2013, TPG Aviator agreed to make a $135 million equity investment in the Company at a price of $14.65 per share of common stock, in exchange for 2,557,474 of our shares of common stock and at a price of $146.50 per share of preferred stock in exchange for 665,754.3 shares of our newly created Series A Preferred Stock, the terms of which are outlined in our Certificate of Designation relating to the Series A Preferred Stock filed with our Certificate of Incorporation, and described under “Description of the Series A Preferred Stock” below. In addition, we agreed to the terms of a Stockholders Agreement and Management Services Agreement, which were entered into upon closing of the Investment on June 20, 2013. TPG’s ownership in the Company was approximately 41.9% on an as-converted basis at the closing of the Investment on June 20, 2013.

For a more detailed description of TPG Aviator’s equity investment in the Company and each of the Investment Documents, see “Description of the Investment Documents” below.

Equity Rights Proposal Highlights

The Company’s common stock is listed on Nasdaq and, as a result, the Company is subject to certain Nasdaq listing rules and regulations. Nasdaq requires that the Conversion Right and the Pre-Emptive Right must be approved by the stockholders prior to taking effect, as described below.

Nasdaq Rule 5635(b) requires stockholder approval prior to any issuance of securities when the issuance will result in a change of control of the Company, which Nasdaq deems to occur when, as a result of the issuance, an investor owns, or has the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership would be the single largest ownership position in the company. Because of this restriction, in exchange for the Investor’s $135 million investment in the Company, the Investor received 2,557,474 shares of our common stock at the closing of the Investment, representing approximately 19.9% of our common stock outstanding prior to the issuance, and, instead of additional shares of our common stock, the Investor received 665,754.3 shares of our newly authorized Series A Preferred Stock. Pursuant to the terms of the Company’s Certificate of Designation relating to the Series A Preferred Stock (the “Certificate of Designation”), the Series A Preferred Stock will only become convertible into our common stock following stockholder approval.

In addition, upon stockholder approval of the Equity Rights Proposal (whether or not the shares of Series A Preferred Stock are converted to shares of common stock), we will increase the size of our board to ten members, which will include two additional directors nominated by TPG Aviator (for a total of four) as described under “Description of the Investment Documents—Stockholders Agreement—Board Representation and Observer Rights.” At the same time, TPG Aviator’s right to appoint two observers to our Board would be terminated. The number of directors that TPG Aviator is entitled to nominate would decrease as the percentage ownership of TPG Aviator and its affiliates falls below certain thresholds, as described under “Description of the Investment Documents—Stockholders Agreement—Board Representation and Observer Rights.”

We agreed in the Securities Purchase Agreement to seek stockholder approval of the Equity Rights Proposal. We are therefore also seeking approval of the Equity Rights Proposal to satisfy our obligations under the Securities Purchase Agreement and in connection with the Investment.

If the Company’s stockholders do not approve the Equity Rights Proposal, then the Conversion Right and Pre-Emptive Right would not become effective. Furthermore, unless and until stockholder approval is subsequently obtained and the Company or the holder(s) of the Series A Preferred Stock elect to convert the Series A Preferred Stock into shares of our common stock, the dividend rate applicable to the Series A Preferred Stock will increase to (i) 8% per annum beginning 180 days after closing of the Investment (which date is December 17, 2013) and continuing for nine months (which ending date is September 17, 2014), (ii) 12% per annum beginning September 18, 2014 and continuing for twelve months (which ending date is September 17, 2015), and (iii) 15% per annum thereafter. During the first nine-month period, the Company may, at its election, pay the dividends in cash or in kind by issuing additional shares of Series A Preferred Stock (as long as the as-converted ownership of TPG Aviator and its affiliates would not exceed 49% of the common stock issued and outstanding). The Company must pay subsequent dividends in cash. These dividends will be net of the amount of any common stock participating dividends received by the holders of Series A Preferred Stock during such periods. In addition, if any Series A Preferred Stock remains outstanding 180 days after closing of the Investment, (a) the liquidation preference for the Series A Preferred Stock will increase by 10%, as described in “Description of the Series A Preferred Stock—Liquidation Rights” below, and (b) the conversion ratio for conversion of the Series A Preferred Stock into the Company’s common stock will increase by 10%, as described in “Description of the Series A Preferred Stock—Conversion” below. The increase in liquidation preference will cause the effective dividend rates on the Series A Preferred Stock to be 10% higher.

Nasdaq has certain additional rules, including Nasdaq Rule 5635(c) that requires stockholder approval prior to certain issuances of securities to directors, that could be implicated in the future if the Investor exercises the Pre-emptive Right. In order to eliminate any requirement that the future exercise of the Pre-emptive Right would require stockholder approval, we are seeking such approval now as part of the Equity Rights Proposal. For a more detailed description of the Pre-Emptive Right, see the description under “Description of the Investment Documents—Stockholders Agreement—Pre-emptive Rights” below.

Additionally, as described under “Description of the Investment Documents—Stockholders Agreement—Pre-emptive Rights” below, unless and until the Company’s stockholders have approved the Equity Rights Proposal, TPG Aviator will have the pre-emptive right (at its option) to purchase, or to designate an affiliate to purchase, TPG Aviator’s pro rata portion of any equity issuances by the Company by purchasing additional shares of Series A Preferred Stock in lieu of, and with the same value as, the securities TPG Aviator otherwise would have been entitled to purchase under its pre-emptive rights described below.

Finally, if the stockholders do not approve the Equity Rights Proposal at the Special Meeting, then upon TPG Aviator’s request, the Company is obligated to use its reasonable best efforts to call additional stockholders’ meetings on two additional occasions during the first year following the closing of the Investment and on an annual basis thereafter for the purpose of obtaining such approval.

Based on the capitalization of the Company as of August 2, 2013, and the current ten-for-one conversion rate of shares of common stock for Series A Preferred Stock, the conversion of all of the Series A Preferred Stock into shares of common stock would result in the Investor owning approximately 41.9% of our outstanding common stock after giving effect to such conversion.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE EQUITY RIGHTS PROPOSAL.

Description of the Investment Documents

The following is a summary of the material terms of (i) the Securities Purchase Agreement, (ii) the Management Services Agreement, and (iii) the Stockholders Agreement. While we believe this summary covers the material terms of these agreements, we encourage you to read each of them; they are included as Exhibits 10.1, 10.2 and 10.3, respectively, to the Current Report on Form 8-K filed with the SEC by the Company on June 20, 2013. Each of these Exhibits to Current Reports on Forms 8-K is incorporated by reference herein. For more information about accessing the Current Reports on Form 8-K and the other information we file with the SEC, please see “Where You Can Find More Information” below.

Securities Purchase Agreement

On June 19, 2013, the Company and TPG Aviator entered into the Securities Purchase Agreement, pursuant to which TPG Aviator agreed to purchase 2,557,474 shares of the Company’s common stock, at a purchase price of $14.65 per share, and 665,754.3 shares of a newly authorized series of the Company’s Series A Preferred Stock, at a purchase price and liquidation preference of $146.50 per share, for an aggregate investment in the Company by TPG Aviator of $135 million. The terms of the Series A Preferred Stock are described under “Description of the Series A Preferred Stock” below. The investment contemplated by the Securities Purchase Agreement closed on June 20, 2013 (the “Closing”).

Closing Conditions

Under the Securities Purchase Agreement, TPG Aviator’s obligation to consummate the investment was conditioned on, among other things, (i) adoption and filing by the Company of the Certificate of Designation creating the Series A Preferred Stock (the terms of which are described under “Description of the Series A Preferred Stock” below), (ii) compliance by the Company with Nasdaq listing requirements (other than obtaining stockholder approval of the Equity Rights Proposal), (iii) reconstitution of the Board and the Board committees to include the requisite initial TPG Aviator nominees (as described under “Stockholders Agreement—Board Representation and Observer Rights” and “Stockholders Agreement—Committee Representation” below); (iv) the continued employment of Roger A. Cregg as our President and Chief Executive Officer; and (v) adoption of a rights agreement to preserve the Company’s net operating losses and certain other tax attributes and entering into a side letter with TPG Aviator with respect to the rights agreement. Each such condition was satisfied at or prior to the Closing, including (a) the Board’s adoption and approval of the Certificate of Designation creating the Series A Preferred Stock on June 19, 2013 and filing of such Certificate of Designation with the Secretary of State of the State of Delaware, (b) the appointment to the Board of each of Kelvin L. Davis and Greg Kranias as designees of TPG Aviator, and (c) the adoption of our rights plan on June 19, 2013 and the entry into a related side letter with TPG Aviator on such date.

Covenants

Pursuant to the Securities Purchase Agreement, the Company has agreed to use its reasonable best efforts to call and hold a meeting of its stockholders within 90 days following the Closing to vote on the approval of the Equity Rights Proposal described under “Proposal One: Equity Rights Proposal” above. If the stockholders do not approve the Equity Rights Proposal at the meeting please markdescribed in this Proxy Statement, TPG Aviator has the boxright to require, on two additional occasions in the first year following the Closing, and on one additional occasion each year thereafter, the Company to use its reasonable best efforts to call another meeting of the stockholders to again seek approval of the Equity Rights Proposal. In advance of any such stockholders’ meeting (including the meeting described in this Proxy Statement), the Company agreed to prepare and file a proxy statement recommending, subject to the Board’s fiduciary duties, that the stockholders vote in favor of the Equity Rights Proposal.

In addition, pursuant to the Securities Purchase Agreement, the Company agreed to apply promptly to cause the shares of common stock purchased by TPG Aviator, as well as the shares of common stock to be issued upon conversion of the Series A Preferred Stock, to be approved for listing on Nasdaq, subject to official notice of issuance.

Representations and Warranties

In the Securities Purchase Agreement, each of the Company and TPG Aviator made certain representations and warranties. The Company’s representations and warranties to TPG Aviator included, among others, representations and warranties with respect to its capitalization and certain other representations regarding matters relating to the Company’s business and the issuance of the Company’s securities. TPG Aviator’s representations and warranties to the Company included, among others, representations and warranties about its status as an accredited investor and its investment intent. The representations and warranties in the Securities Purchase Agreement survive until the first anniversary of the Closing (i.e., June 19, 2014).

Stockholders are not third-party beneficiaries under the Securities Purchase Agreement and should not construe the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company, TPG Aviator or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Securities Purchase Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. The provisions of the Securities Purchase Agreement, including the representations and warranties, should not be read alone, but instead should only be read together with the information provided elsewhere in this Proxy Statement and in the documents incorporated by reference into this Proxy Statement, including the periodic and current reports and statements that the Company files with the SEC. For more information regarding these documents incorporated by reference, see “Where You Can Find More Information” below.

Management Services Agreement

On June 20, 2013, the Company and TPG Management entered into the Management Services Agreement, pursuant to which the Company agreed to pay certain fees and expenses to TPG Management or its designees in exchange for certain management, advisory and consulting services that had been provided or will be provided by TPG Management or its designees in connection with the Investment and TPG Management’s and its designees’ ongoing services to the Company.

Pursuant to the Management Services Agreement, upon closing of the Investment, the Company paid TPG Management or its designees a “transaction fee” equal to $4,725,000 (or 3.5% of the aggregate amount invested by TPG Aviator in the Investment). In addition, upon closing of the Investment, the Company reimbursed TPG Management or its designees for $1,000,000 of actual third-party out-of-pocket expenses (including attorneys’ fees, accountants’ fees and other third-party fees) incurred by or on your proxy cardbehalf of TPG Management and its affiliates in connection with the Investment.

Also, pursuant to the Management Services Agreement and in exchange for certain ongoing advisory and consulting services, AV Homes agreed to pay to TPG Management a monitoring fee equal to $465,000 per year for so long as TPG Aviator and its affiliates own at least 30% of the common stock outstanding (assuming full conversion of the Series A Preferred Stock) and also to reimburse expenses incurred by TPG Management and its affiliates to provide services or enforce its rights under the Management Services Agreement. In each case, the monitoring fee will be reduced proportionately based on TPG Aviator’s Board representation rights under the Stockholders Agreement (as such rights are described under “Stockholders Agreement—Board Representation and Observer Rights” below). The monitoring fee will be payable quarterly in advance. The monitoring fee will be reduced by director fees otherwise payable to the TPG Aviator-nominated members of the Board.

AV Homes has agreed to indemnify and hold harmless TPG Management and its affiliates, and release them from all liability, for losses related to the Management Services Agreement, except those finally determined to have arisen from the gross negligence, bad faith or willful misconduct of TPG Management or such affiliate.

The Management Services Agreement will automatically terminate on the date TPG Aviator no longer has the right to designate any nominees to the Board (as such nomination rights are described under “Stockholders Agreement—Board Representation and Observer Rights” below).

Stockholders Agreement

On June 20, 2013, the Company and TPG Aviator entered into the Stockholders Agreement in order to establish various arrangements with respect to governance of the Company, certain actions that may or may not be taken with respect to, and certain rights with respect to, the common stock and Series A Preferred Stock owned by TPG Aviator.

Board Representation and Observer Rights

Prior to stockholder approval of the Equity Rights Proposal, we are required to maintain an eight member board and TPG Aviator is entitled to nominate two individuals to serve on our Board, as well as two additional non-voting observers. On June 19, 2013, Kelvin L. Davis and Greg Kranias (collectively, the “Initial TPG Directors”) were appointed to our Board, effective as of the Closing, upon designation by TPG Aviator. As of the date of this Proxy Statement, TPG Aviator has appointed Paul Hackwell as a non-voting observer to the Board, but has not exercised its right to appoint a second non-voting observer. None of the Initial TPG Directors participated in his capacity as a director in discussions of, or vote with respect to, matters related to the Investment that were approved by our Board, including our Board vote recommending approval of the issuance of common stock and issuance of common stock upon conversion of the Series A Preferred Stock.

Pursuant to the terms of the Stockholders Agreement, from and after the date stockholders approve the Equity Rights Proposal, the Company is required to increase the size of the Board to include ten members, TPG Aviator will no longer have the right to designate non-voting observers to our Board and, assuming TPG Aviator and its affiliates hold at least 80% of the common stock they held at Closing (assuming full conversion of the Series A Preferred Stock, whether or not such Series A Preferred Stock has actually been converted), then TPG Aviator will be entitled to nominate two additional directors (for a total of four). Thereafter, TPG Aviator will continue to be entitled to nominate to the Board (i) four directors if the ownership of TPG Aviator and its affiliates is at least 30%, (ii) three directors if the ownership of TPG Aviator and its affiliates is at least 20%, but less than 30%, (iii) two directors if the ownership of TPG Aviator and its affiliates is at least 15% but less than 20%, and (iv) one director if the ownership of TPG Aviator and its affiliates is at least 5% but less than 15%. TPG has no Board nomination rights if its level of ownership of the Company is less than 5%. Each of the forgoing percentages refers to a percentage of the Company’s outstanding common stock, assuming full conversion of the Series A Preferred Stock (whether or not such Series A Preferred Stock has actually been converted).

Provided that TPG Aviator, together with its affiliates, maintains its ownership level within these ranges, the Company will include the specified number of persons designated by TPG Aviator in the Company’s slate of Board nominees for election by the Company’s stockholders and will use its commercially reasonable efforts to cause such nominees to be elected to the Board. Subject to its fiduciary duties, applicable law and Nasdaq listing requirements, the Board is required to recommend that the Company’s stockholders vote in favor of the election of all of the TPG Aviator nominees and may not recommend any other person for any position sought by a TPG Aviator nominee. Further, the Board may not withdraw such nomination or, subject to its fiduciary duties, recommendation without TPG Aviator’s consent. Each TPG Aviator nominee that is elected to the Board will receive the same indemnification rights and will be entitled to the same insurance coverage as is provided to each of the other Board members, and will be exculpated from liability for damages to the fullest extent permitted by

law. The indemnification agreements entered into with each TPG Aviator nominee also include (i) confirmation that the Company is an indemnitor of first resort and other provisions addressing the interaction of various indemnification rights and (ii) an express waiver of any interest or expectancy the Company may have in any corporate opportunity presented to the TPG Aviator nominees or otherwise.

The Stockholders Agreement sets forth certain criteria that TPG Aviator nominees must meet, including, among others, having the requisite skill and experience to serve as a director of a publicly traded company, not being prohibited from or disqualified from serving as a director pursuant to any rule or regulation of the SEC, Nasdaq or applicable law and meeting certain Nasdaq independence standards, and provides the Board the right, subject to certain requirements, to object to the nomination or appointment of any such nominee to the Board or to a Board committee that does not meet the applicable criteria, in which case TPG Aviator will be allowed to designate another person who meets the specified requirements for nomination or appointment, as applicable, to the Board or to such Board committee.

Further, the Stockholders Agreement requires that TPG Aviator cause one or more of its nominees to resign from the Board in certain circumstances. Specifically, TPG Aviator will cause any of its nominees to resign from the Board (including any Board committees) if such nominee is prohibited or disqualified from serving on the Board by certain rules and regulations or by applicable law or has engaged in certain specified wrongful activities. Upon the death, resignation or removal of a TPG Aviator nominee from the Board, TPG Aviator will have the right to designate a new director to fill the resulting vacancy (including pursuant to the preceding sentence), as long as TPG Aviator’s and its affiliates’ ownership level does not fall below the applicable ownership threshold set forth above.

Finally, the Stockholders Agreement provides that, notwithstanding the nomination and appointment rights described above, in no case will the Board be prevented from acting (or refusing to act) in accordance with its fiduciary duties, applicable law or Nasdaq listing requirements.

Committee Representation

In addition, the Stockholders Agreement requires the Company to constitute each of its Compensation Committee and a newly established Finance Committee (described below) as a five member committee and (i) for so long as the ownership of TPG Aviator and its affiliates is at least 15%, TPG Aviator has the right to have two Board members appointed to each such committee, and (ii) for so long as the ownership of TPG Aviator and its affiliates is at least 5% but less than 15%, TPG Aviator has the right to have one Board member appointed to each such committee. The Company also agreed that the entire Board (including TPG Aviator nominees) shall be included on its Executive Committee. For so long as the ownership of TPG Aviator and its affiliates is at least 5%, each other committee of the Board will be constituted as a three member committee and TPG Aviator has the right to have one Board member appointed to each such committee. TPG Aviator has no such committee appointment rights if its level of ownership the Company is less than 5%. Each of the forgoing percentages refers to a percentage of the Company’s outstanding common stock, assuming full conversion of the Series A Preferred Stock.

In furtherance of these rights, effective as of the Closing, Kelvin L. Davis was appointed to the Nominating and Governance, Compensation, Executive and Finance Committees and Greg Kranias was appointed to the Compensation, Executive and Finance Committees. As of the date of this Proxy Statement, TPG Aviator has not exercised its right under the Stockholders Agreement to designate a member of the Audit Committee.

Upon the death, resignation or removal of a TPG Aviator nominee from any Board committee, TPG Aviator will have the right to designate a new director to fill the resulting vacancy, as long as TPG Aviator’s and its affiliates’ ownership level does not fall below the applicable ownership threshold set forth above.

The Stockholders Agreement also provides that, for so long as TPG Aviator is entitled to designate at least one member of the Finance and Compensation Committees (such period, the “Committee Designation Period”),

the Board must maintain a Finance Committee and a Compensation Committee, each of which Committees will have certain approval rights requiring the affirmative vote of a majority of its members before the Board may take certain actions, as described below.

During the Committee Designation Period, the Board may not authorize or cause to be taken any of the following actions without the requisite approval of the Finance Committee (which approval, for so long as TPG Aviator is entitled to nominate two members of the Finance Committee, in most cases must include the affirmative vote of at least one committee member nominated by TPG Aviator):

any sale or issuance of any capital stock or other security of the Company or any subsidiary (including options and convertible or exchangeable instruments), except for Permitted Issuances (as defined below);

any redemption, purchase, repurchase or other acquisition of capital stock of the Company (other than the Series A Preferred Stock or in connection with equity compensation arrangements);

any incurrence or assumption of liability for indebtedness other than certain ordinary course borrowings;

any hiring or firing of members of senior management;

any land or builder acquisitions, any acquisition or dispositions of subsidiaries or any other acquisitions or dispositions that are greater, in each case, than $5 million (including total expected capital requirements associated with the acquisition or disposition of the land, as the case may be, and all land development work required to get the land ready for the construction of homes);

any capital expenditures or land commitments over the budget approved by the Board, or otherwise greater than $10 million; and

any entry into new markets or lines of business.

Under the Stockholders Agreement, “Permitted Issuance” means (a) issuances of the capital stock of the Company upon the exercise of options or other rights to purchase or acquire capital stock of the Company outstanding on the date of the Stockholders Agreement, (b) issuances pursuant to the Company’s existing compensation arrangements for its directors, officers, employees, consultants and agents, or issuances pursuant to the Company’s future compensation arrangements that have been approved by the Board’s Compensation Committee, (c) issuances of Series A Preferred Stock as a paid-in-kind dividend on the outstanding shares of Series A Preferred Stock (as described under “Description of the Series A Preferred Stock—Dividend Rights” below), (e) issuances of common stock upon conversion of Series A Preferred Stock (as described under “Description of the Series A Preferred Stock—Conversion” below) and (e) issuances of capital stock of a subsidiary to the Company or another subsidiary.

Also, during the Committee Designation Period, the Board may not authorize or cause to be taken any of the following actions without the requisite approval of the Compensation Committee (which approval, for so long as TPG Aviator is entitled to nominate two members of the Compensation Committee, in most cases must include the approval of four out of the five members of the Compensation Committee):

any adoption of any new, or expansion of any existing, equity incentive plan; and

any changes to, or the adoption of, any compensation arrangements for any members of the Board or members of senior management.

Consent Rights

For so long as TPG Aviator, together with its affiliates, continues to own at least the greater of (i) 25% of the Company’s common stock that TPG Aviator and its affiliates owned as of the Closing or (ii) 10% of the Company’s common stock outstanding (in each case assuming full conversion of the Series A Preferred Stock, whether or not such Series A Preferred Stock has actually been converted), the Company must obtain TPG Aviator’s prior written consent for any of the following actions:

Any amendment to the governing documents of the Company or its subsidiaries adverse to TPG;

Any voluntary liquidation, dissolution or winding up of the Company;

Any voluntary bankruptcy or insolvency action, or any consent to any involuntary bankruptcy or similar proceeding;

Any increase or decrease in the size of the Board or any committee;

Any change in the rights and responsibilities of either the Finance Committee of the Board or the Compensation Committee of the Board (other than as expressly contemplated by the Stockholders Agreement or as may be required to comply with any applicable SEC or NASDAQ rule or other applicable Law); and

Any issuance of equity securities that are senior to the common stock of the Company.

Pre-emptive Rights

Under the Stockholders Agreement, except in the case of Permitted Issuances (as defined under “Committee Representation” above), TPG Aviator has a pre-emptive right (but not an obligation) to participate in, or designate an affiliate to participate in, future equity issuances by the Company or its subsidiaries of capital stock or other securities convertible or exchangeable into capital stock for so long as TPG Aviator, together with its affiliates, beneficially owns at least 10% of the Company’s outstanding common stock (assuming full conversion of the Series A Preferred Stock, whether or not such Series A Preferred Stock has actually been converted). TPG Aviator has the option to participate in any such equity issuance by purchasing, or designating its affiliates to purchase, in the aggregate up to its pro rata portion of such equity issuance (based on the ownership percentage of TPG Aviator and its affiliates of the Company’s outstanding common stock, assuming full conversion of the Series A Preferred Stock, whether or not such Series A Preferred Stock has actually been converted) at the same price and the same terms and conditions as offered to other investors. If such equity issuance is underwritten, TPG Aviator, or its designated affiliates, may purchase up to its pro rata portion of such underwritten equity issuance at the price offered to the public, net of any underwriters’ discounts or commissions applicable to such publicly offered shares. However, unless and until the Company’s stockholders (excluding TPG Aviator) have approved the Conversion Right that is part of the Equity Rights Proposal, TPG Aviator will have the right (at its option) to purchase, or to designate an affiliate to purchase, TPG Aviator’s pro rata portion of such equity issuance in the form of Series A Preferred Stock in lieu of, and with the same value as, the securities TPG Aviator otherwise would have been entitled to purchase. The Company is seeking stockholder approval of the Equity Rights Proposal (see “Proposal One: Equity Rights Proposal” above).

The Stockholders Agreement provides that TPG Aviator will have 15 business days (or such shorter period as may be required) following notice from the Company regarding the proposed equity issuance to exercise its pre-emptive rights. If TPG Aviator does not exercise its pre-emptive rights within the applicable period, the Company may sell the equity interests in question to other investors. If the Company has not sold the equity interests within 90 days of its original notice to TPG Aviator, the Company must provide TPG Aviator with a new notice prior to undertaking a subsequent equity issuance.

Registration Rights

Pursuant to the Stockholders Agreement, the Company has provided TPG Aviator and TPG Management with certain registration rights with respect to the Company’s common stock and, beginning two years after the Closing, the Series A Preferred Stock if any such Series A Preferred Stock is then still unconverted, as described in more detail below.

Beginning six months after the Closing, the holders of a majority of the Registrable Securities (as defined below) will have the right to require that the Company file, within 90 days of such demand, a registration statement with the SEC registering some or all of such holders’ Registrable Securities. The holders of the Registrable Securities are limited to three demand registrations in total and no more than one demand registration in any 6-month period, and may only make a demand registration if the aggregate offering price is expected to exceed $5 million. If the offering of Company securities pursuant to a demand registration is in the form of an underwritten public offering, (i) TPG Aviator may designate the managing underwriter(s) and (ii) to the extent requested by the underwriter(s), the Company may reduce the number of Registrable Securities to be included in the registration. The Company, however, will not be obligated to effect or participate in any underwritten offering during any lock-up period required by the underwriter(s) in any prior underwritten offering conducted by the Company on its own behalf or on behalf of holders of the Registrable Securities.

Under the Stockholders Agreement, “Registrable Securities” means (i) at any time, the shares of the Company’s common stock held beneficially or of record by TPG Aviator or its permitted transferees (including its controlled affiliates and equity holders, and the controlled affiliates and equity holders of such persons) and (ii) from and after the two-year anniversary of the Closing, the shares of Series A Preferred Stock, in each case including shares of the Company’s common stock or Series A Preferred Stock, as applicable, acquired by dividend, stock split, recapitalization, plan of reorganization, merger, sale of assets or otherwise. Registrable Securities cease to be Registrable Securities when they are sold pursuant to an effective registration statement or when they may be sold without registration pursuant to Rule 144 under the Securities Act of 1933, as amended (“Rule 144”) without limitation on volume or manner of sale.

In addition to the foregoing demand registration rights, beginning six months after the Closing, holders of Registrable Securities will have piggyback registration rights pursuant to which such holders may require the inclusion of some or all of their Registrable Securities in any registration filed by the Company for the account of the Company or any of the Company’s other security holders (provided that the registration permits the inclusion of such Registrable Securities). In any such registration that is an underwritten offering, the Company has the right to select the managing underwriter(s), and, to the extent requested by the underwriter(s), the Company may reduce the number of the requesting holders’ Registrable Securities to be included in any such registration.

The Company will pay all of the costs and expenses incurred in connection with all demand and piggyback registrations under the Stockholders Agreement. The Company will not, however, be obligated to pay any out-of-pocket expenses incurred by holders of Registrable Securities (other than the expenses of one counsel for all such holders) or any underwriting discounts and commissions attributable to the sale of such holders’ Registrable Securities.

Pursuant to the Stockholders Agreement, holders of Registrable Securities are obligated to discontinue disposition of Company securities in the event that changes in a registration statement or prospectus are required so that wethey will not contain any untrue statement of a material fact or omit any material fact required to be stated therein or necessary to make the statements therein not misleading in light of the circumstances in which they were made until the Company corrects the disclosure. In addition, the Company may send you(i) postpone effecting a registration, or (ii) require holders to refrain from disposing of Company securities, in either case for a period of no more than 45 consecutive days from the delivery of a notice to such effect (and not in excess of 90 days in the aggregate in any 12-month period) if (x) the Board in good faith determines that such registration or disposition would materially impede, delay or interfere with any material transaction then pending or proposed to be undertaken by the Company or any of its subsidiaries, or (y) the Company in good faith determines that the

Company is in possession of material non-public information the disclosure of which during the period specified in such notice the Board, in good faith, reasonably believes would not be in the best interests of the Company.

The Company and the holders of Registrable Securities have agreed, in connection with any underwritten offering and upon the request of the underwriter(s), to enter into customary “lock-up” agreements restricting sales of, offers for sale of and other dispositions of shares of the Company’s common stock or other securities exchangeable or convertible into the Company’s common stock, with such restrictions not to exceed 90 days. The Company further agreed to use commercially reasonable efforts to obtain similar lock-up agreements from the Company’s directors and executive officers in connection with an attendance card.underwritten offering in which Registrable Securities are being sold.

The Stockholders who haveAgreement provides that the registration rights described above terminate on the earlier of (i) the date on which none of TPG Aviator, its respective controlled affiliates or equity holders, or any controlled affiliates or equity holders of any such person, owns any Company securities or (ii) the date on which all Registrable Securities are eligible to be sold without limitation or restriction (e.g., pursuant to Rule 144).

The Stockholders Agreement provides for customary registration rights indemnification by each of the Company and the holders of Registrable Securities.

Standstill Agreement

Until the earliest of (i) the date on which TPG Aviator, together with its affiliates, no longer collectively owns at least 5% of the Company’s common stock (assuming full conversion of the Series A Preferred Stock, whether or not such Series A Preferred Stock has actually been converted), (ii) the third anniversary of the Closing or (iii) consummation of a Change of Control (as defined below), neither TPG Aviator nor its affiliates will be permitted to, directly or indirectly, without prior written approval of the Company:

acquire, offer or propose to acquire or agree to acquire beneficial ownership of Commonany voting securities of the Company (subject to certain exceptions, such as acquisitions upon conversion of the Series A Preferred Stock, as described under “Description of the Series A Preferred Stock” below, stock splits or dividends, acquisitions directly from the Company and purchases to restore TPG Aviator’s and its affiliates’ aggregate percentage interest in the Company to the same level as at the Closing);

enter into or otherwise be involved in any agreement to provide equity financing for a proposed or actual acquisition transaction, merger or other business combination (including asset sales) with respect to the Company or any of its subsidiaries;

other than solely with respect to seeking stockholder approval of the Equity Rights Proposal or election of nominees to the Board designated by TPG Aviator pursuant to the terms of the Stockholders Agreement, make or participate in any “solicitation” of “proxies” (generally as defined under Regulation 14A under the Exchange Act) to vote, or seek to advise or influence any person with respect to the voting of, any common stock of the Company or any of its subsidiaries;

other than solely with respect to seeking stockholder approval of the Equity Rights Proposal, call or seek to call a meeting of the Company’s stockholders or initiate any stockholder proposal, or form, join or participate in a “group” (within the meaning of Section 13(d)(3) of the Exchange Act) with respect to the Company’s voting securities;

deposit any securities of the Company into a voting trust, or subject any securities of the Company to any other agreement with respect to the voting of such securities;

seek representation on the Board, a change in the composition of the Board, a change in the number of directors elected by the holders of the Company’s common stock, or a change in the number of such directors who represent TPG Aviator, in each case other than as expressly contemplated by the Stockholders Agreement; or

contest the validity of the standstill.

These restrictions will be suspended upon the occurrence of any of the following events, but only so long as TPG Aviator and its affiliates did not directly or indirectly assist, facilitate, encourage or participate in such events (provided, that such restrictions will be reinstated upon the ceasing to occur, withdrawal or abandonment, as the case may be, of such events):

the commencement of a tender or exchange offer by a third party seeking to acquire 50% or more of the beneficial ownership of the Company’s outstanding voting securities;

the filing of a preliminary proxy statement by a third party with respect to a proxy or consent solicitation to elect or remove any directors of the Company;

the adoption by the Board of a plan of liquidation or dissolution;

a material breach by the Company of material obligations under the Stockholders Agreement (subject to the opportunity to cure such breach within 10 days of notice of the breach); or

the failure to pay dividends on the Series A Preferred Stock for three successive fiscal quarters.